- Information Technology

- Data Infrastructure

- Data Tools

- Desktops, Laptops and OS

- Chip Sets

- Collaboration Tools

- Desktop Systems - PCs

- Email Client

- Embedded Systems

- Hardware and Periferals

- Laptops

- Linux - Open Source

- Mac OS

- Memory Components

- Mobile Devices

- Presentation Software

- Processors

- Spreadsheets

- Thin Clients

- Upgrades and Migration

- Windows 7

- Windows Vista

- Windows XP

- Word Processing

- Workstations

- Enterprise Applications

- IT Infrastructure

- IT Management

- Networking and Communications

- Bluetooth

- DSL

- GPS

- GSM

- Industry Standard Protocols

- LAN - WAN

- Management

- Mobile - Wireless Communications

- Network

- Network Administration

- Network Design

- Network Disaster Recovery

- Network Interface Cards

- Network Operating Systems

- PBX

- RFID

- Scalability

- TCP - IP

- Telecom Hardware

- Telecom Regulation

- Telecom Services

- Telephony Architecture

- Unified Communications

- VPNs

- VoIP - IP Telephony

- Voice Mail

- WAP

- Wi-Fi (802.11)

- WiMAX (802.16)

- Wide Area Networks (WAN)

- Wireless Internet

- Wireless LAN

- Security

- Servers and Server OS

- Software and Web Development

- .Net Framework

- ASPs

- Application Development

- Application Servers

- Collaboration

- Component-Based

- Content Management

- E-Commerce - E-Business

- Enterprise Applications

- HTML

- IM

- IP Technologies

- Integration

- Internet

- Intranet

- J2EE

- Java

- Middleware

- Open Source

- Programming Languages

- Quality Assurance

- SAAS

- Service-Oriented Architecture (SOA)

- Software Engineering

- Software and Development

- Web Design

- Web Design and Development

- Web Development and Technology

- XML

- Storage

- Agriculture

- Automotive

- Career

- Construction

- Education

- Engineering

- Broadcast Engineering

- Chemical

- Civil and Environmental

- Control Engineering

- Design Engineering

- Electrical Engineering

- GIS

- General Engineering

- Industrial Engineering

- Manufacturing Engineering

- Materials Science

- Mechanical Engineering

- Medical Devices

- Photonics

- Power Engineering

- Process Engineering

- Test and Measurement

- Finance

- Food and Beverage

- Government

- Healthcare and Medical

- Human Resources

- Information Technology

- Data Infrastructure

- Data Tools

- Desktops, Laptops and OS

- Chip Sets

- Collaboration Tools

- Desktop Systems - PCs

- Email Client

- Embedded Systems

- Hardware and Periferals

- Laptops

- Linux - Open Source

- Mac OS

- Memory Components

- Mobile Devices

- Presentation Software

- Processors

- Spreadsheets

- Thin Clients

- Upgrades and Migration

- Windows 7

- Windows Vista

- Windows XP

- Word Processing

- Workstations

- Enterprise Applications

- IT Infrastructure

- IT Management

- Networking and Communications

- Bluetooth

- DSL

- GPS

- GSM

- Industry Standard Protocols

- LAN - WAN

- Management

- Mobile - Wireless Communications

- Network

- Network Administration

- Network Design

- Network Disaster Recovery

- Network Interface Cards

- Network Operating Systems

- PBX

- RFID

- Scalability

- TCP - IP

- Telecom Hardware

- Telecom Regulation

- Telecom Services

- Telephony Architecture

- Unified Communications

- VPNs

- VoIP - IP Telephony

- Voice Mail

- WAP

- Wi-Fi (802.11)

- WiMAX (802.16)

- Wide Area Networks (WAN)

- Wireless Internet

- Wireless LAN

- Security

- Servers and Server OS

- Software and Web Development

- .Net Framework

- ASPs

- Application Development

- Application Servers

- Collaboration

- Component-Based

- Content Management

- E-Commerce - E-Business

- Enterprise Applications

- HTML

- IM

- IP Technologies

- Integration

- Internet

- Intranet

- J2EE

- Java

- Middleware

- Open Source

- Programming Languages

- Quality Assurance

- SAAS

- Service-Oriented Architecture (SOA)

- Software Engineering

- Software and Development

- Web Design

- Web Design and Development

- Web Development and Technology

- XML

- Storage

- Life Sciences

- Lifestyle

- Management

- Manufacturing

- Marketing

- Meetings and Travel

- Multimedia

- Operations

- Retail

- Sales

- Trade/Professional Services

- Utility and Energy

- View All Topics

Share Your Content with Us

on TradePub.com for readers like you. LEARN MORE

Request Your Free White Paper Now:

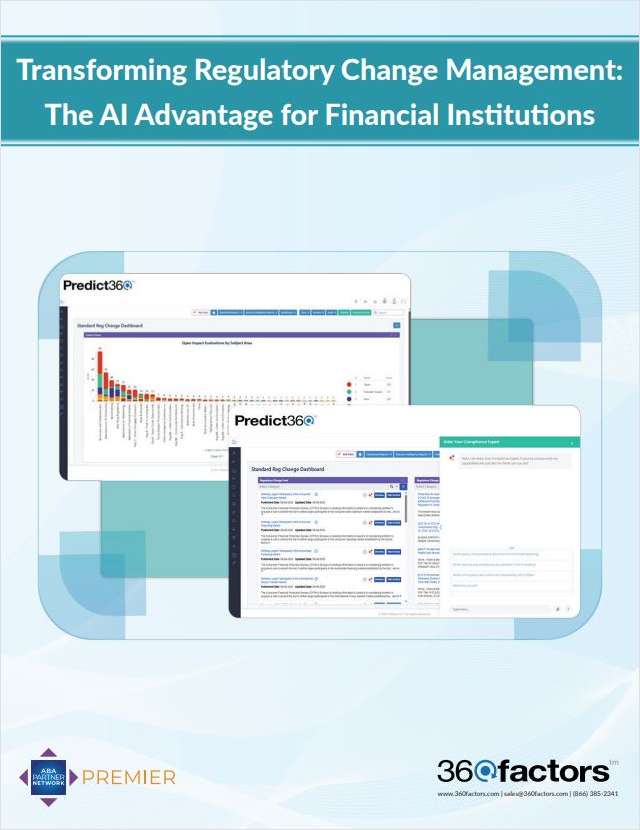

"Transforming Regulatory Change Management: The AI Advantage for Financial Institutions"

From Burden to Advantage: Rethinking Regulatory Compliance

The pace of regulatory changes for banks and financial institutions has accelerated dramatically in 2025. From cybersecurity and consumer protection laws to evolving AML requirements, compliance teams now need to track, interpret, and implement an increasing volume of regulations. Traditional methods, such as manual regulatory tracking, spreadsheets, and fragmented workflows, have left organizations vulnerable to compliance risks, fines, and reputational damage.

This white paper explores why banks, insurance, and financial services organizations must move beyond outdated approaches to RCM. It outlines the critical shortcomings of traditional methods, which make it increasingly difficult for compliance teams to keep pace with regulators’ expectations. It also examines how embedding AI into RCM can transform compliance into a strategic capability.

You’ll discover how AI tools like Kaia, the integrated AI compliance expert within Predict360, are improving the way in which banks manage regulatory changes. From easier understanding of complex rulebooks and contextual insights to automated policy drafts, AI equips financial institutions with faster, more accurate, and scalable compliance operations.

Download the white paper to see how your organization can reduce regulatory risk and manage the challenges of today’s compliance landscape through the power of AI.

Download this free white paper to learn more about:

- Understand why manual, outdated RCM methods put institutions at risk.

- Learn how AI-powered solutions offer speed, accuracy, and scalability in compliance.

- Explore how practical AI tools like Kaia are streamlining monitoring and policy mapping.

- Build traceable, transparent compliance processes that regulators can trust.

- Shift from reactive firefighting to proactive, risk-aware decision-making for compliance.

Offered Free by: 360factors

See All Resources from: 360factors