- Information Technology

- Data Infrastructure

- Data Tools

- Desktops, Laptops and OS

- Chip Sets

- Collaboration Tools

- Desktop Systems - PCs

- Email Client

- Embedded Systems

- Hardware and Periferals

- Laptops

- Linux - Open Source

- Mac OS

- Memory Components

- Mobile Devices

- Presentation Software

- Processors

- Spreadsheets

- Thin Clients

- Upgrades and Migration

- Windows 7

- Windows Vista

- Windows XP

- Word Processing

- Workstations

- Enterprise Applications

- IT Infrastructure

- IT Management

- Networking and Communications

- Bluetooth

- DSL

- GPS

- GSM

- Industry Standard Protocols

- LAN - WAN

- Management

- Mobile - Wireless Communications

- Network

- Network Administration

- Network Design

- Network Disaster Recovery

- Network Interface Cards

- Network Operating Systems

- PBX

- RFID

- Scalability

- TCP - IP

- Telecom Hardware

- Telecom Regulation

- Telecom Services

- Telephony Architecture

- Unified Communications

- VPNs

- VoIP - IP Telephony

- Voice Mail

- WAP

- Wi-Fi (802.11)

- WiMAX (802.16)

- Wide Area Networks (WAN)

- Wireless Internet

- Wireless LAN

- Security

- Servers and Server OS

- Software and Web Development

- .Net Framework

- ASPs

- Application Development

- Application Servers

- Collaboration

- Component-Based

- Content Management

- E-Commerce - E-Business

- Enterprise Applications

- HTML

- IM

- IP Technologies

- Integration

- Internet

- Intranet

- J2EE

- Java

- Middleware

- Open Source

- Programming Languages

- Quality Assurance

- SAAS

- Service-Oriented Architecture (SOA)

- Software Engineering

- Software and Development

- Web Design

- Web Design and Development

- Web Development and Technology

- XML

- Storage

- Agriculture

- Automotive

- Career

- Construction

- Education

- Engineering

- Broadcast Engineering

- Chemical

- Civil and Environmental

- Control Engineering

- Design Engineering

- Electrical Engineering

- GIS

- General Engineering

- Industrial Engineering

- Manufacturing Engineering

- Materials Science

- Mechanical Engineering

- Medical Devices

- Photonics

- Power Engineering

- Process Engineering

- Test and Measurement

- Finance

- Food and Beverage

- Government

- Healthcare and Medical

- Human Resources

- Information Technology

- Data Infrastructure

- Data Tools

- Desktops, Laptops and OS

- Chip Sets

- Collaboration Tools

- Desktop Systems - PCs

- Email Client

- Embedded Systems

- Hardware and Periferals

- Laptops

- Linux - Open Source

- Mac OS

- Memory Components

- Mobile Devices

- Presentation Software

- Processors

- Spreadsheets

- Thin Clients

- Upgrades and Migration

- Windows 7

- Windows Vista

- Windows XP

- Word Processing

- Workstations

- Enterprise Applications

- IT Infrastructure

- IT Management

- Networking and Communications

- Bluetooth

- DSL

- GPS

- GSM

- Industry Standard Protocols

- LAN - WAN

- Management

- Mobile - Wireless Communications

- Network

- Network Administration

- Network Design

- Network Disaster Recovery

- Network Interface Cards

- Network Operating Systems

- PBX

- RFID

- Scalability

- TCP - IP

- Telecom Hardware

- Telecom Regulation

- Telecom Services

- Telephony Architecture

- Unified Communications

- VPNs

- VoIP - IP Telephony

- Voice Mail

- WAP

- Wi-Fi (802.11)

- WiMAX (802.16)

- Wide Area Networks (WAN)

- Wireless Internet

- Wireless LAN

- Security

- Servers and Server OS

- Software and Web Development

- .Net Framework

- ASPs

- Application Development

- Application Servers

- Collaboration

- Component-Based

- Content Management

- E-Commerce - E-Business

- Enterprise Applications

- HTML

- IM

- IP Technologies

- Integration

- Internet

- Intranet

- J2EE

- Java

- Middleware

- Open Source

- Programming Languages

- Quality Assurance

- SAAS

- Service-Oriented Architecture (SOA)

- Software Engineering

- Software and Development

- Web Design

- Web Design and Development

- Web Development and Technology

- XML

- Storage

- Life Sciences

- Lifestyle

- Management

- Manufacturing

- Marketing

- Meetings and Travel

- Multimedia

- Operations

- Retail

- Sales

- Trade/Professional Services

- Utility and Energy

- View All Topics

Share Your Content with Us

on TradePub.com for readers like you. LEARN MORE

Request Your Free Product Overview Now:

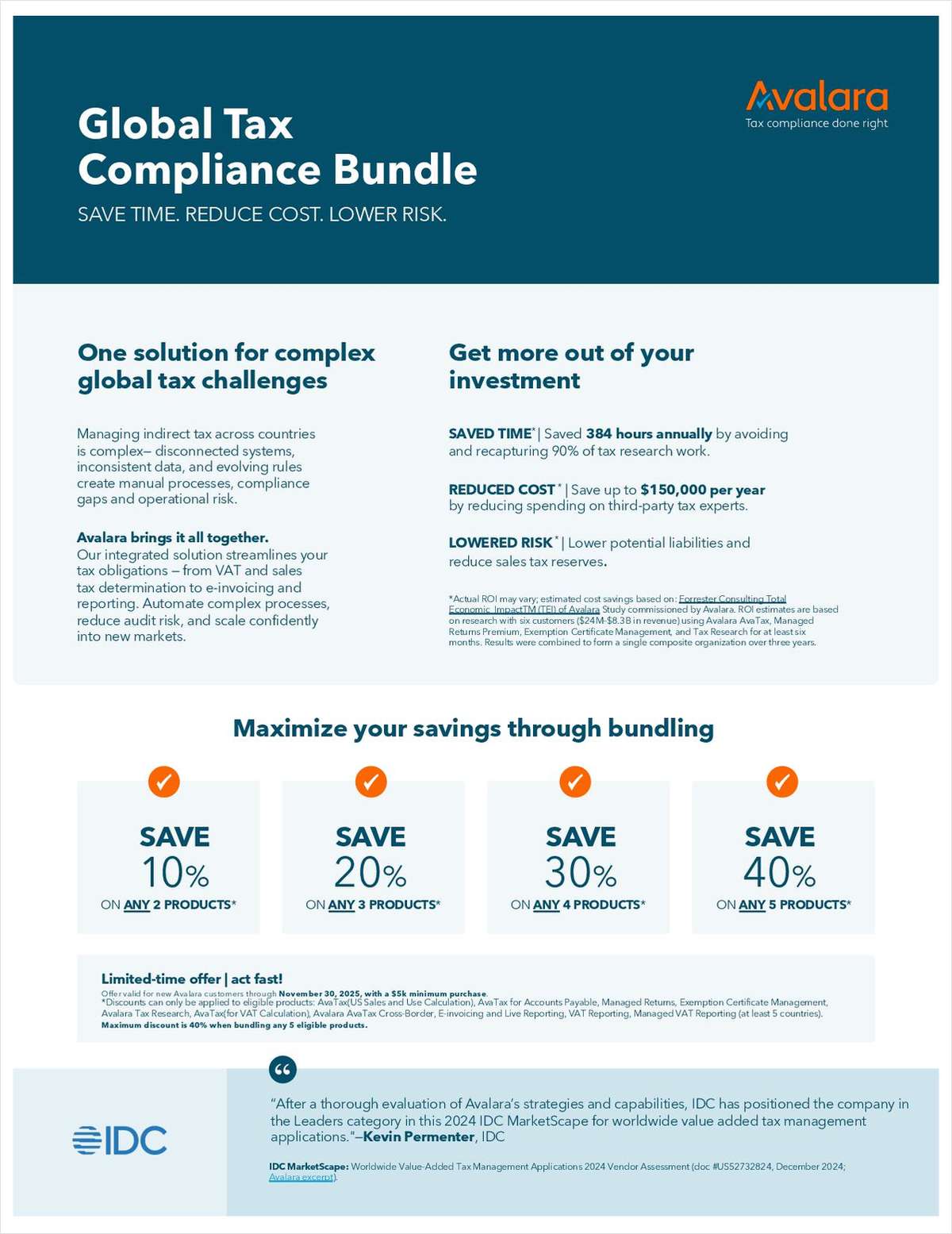

"Global Tax Compliance Bundle Save Time. Reduce Cost. Lower Risk"

Managing indirect tax across countries is challenging with disconnected systems and evolving rules. Integrated solutions streamline VAT, sales tax, e-invoicing, and reporting to automate processes and reduce compliance risk. Review this overview to see how unified platforms support global tax operations.

Managing indirect tax compliance across multiple countries poses operational challenges. Disconnected systems, inconsistent data, and evolving regulations result in manual processes, compliance gaps, and audit risks for globally expanding businesses.

This overview highlights how an integrated tax solution streamlines VAT, sales tax determination, e-invoicing, and reporting. Benefits include:

· Saving up to 384 hours annually via automated workflows

· Cutting costs by up to $150,000 per year by reducing reliance on third-party experts

· Lowering risk through improved accuracy and reduced liabilities

Explore how unified tax technology supports global expansion.

Offered Free by: Avalara

See All Resources from: Avalara