- Information Technology

- Data Infrastructure

- Data Tools

- Desktops, Laptops and OS

- Chip Sets

- Collaboration Tools

- Desktop Systems - PCs

- Email Client

- Embedded Systems

- Hardware and Periferals

- Laptops

- Linux - Open Source

- Mac OS

- Memory Components

- Mobile Devices

- Presentation Software

- Processors

- Spreadsheets

- Thin Clients

- Upgrades and Migration

- Windows 7

- Windows Vista

- Windows XP

- Word Processing

- Workstations

- Enterprise Applications

- IT Infrastructure

- IT Management

- Networking and Communications

- Bluetooth

- DSL

- GPS

- GSM

- Industry Standard Protocols

- LAN - WAN

- Management

- Mobile - Wireless Communications

- Network

- Network Administration

- Network Design

- Network Disaster Recovery

- Network Interface Cards

- Network Operating Systems

- PBX

- RFID

- Scalability

- TCP - IP

- Telecom Hardware

- Telecom Regulation

- Telecom Services

- Telephony Architecture

- Unified Communications

- VPNs

- VoIP - IP Telephony

- Voice Mail

- WAP

- Wi-Fi (802.11)

- WiMAX (802.16)

- Wide Area Networks (WAN)

- Wireless Internet

- Wireless LAN

- Security

- Servers and Server OS

- Software and Web Development

- .Net Framework

- ASPs

- Application Development

- Application Servers

- Collaboration

- Component-Based

- Content Management

- E-Commerce - E-Business

- Enterprise Applications

- HTML

- IM

- IP Technologies

- Integration

- Internet

- Intranet

- J2EE

- Java

- Middleware

- Open Source

- Programming Languages

- Quality Assurance

- SAAS

- Service-Oriented Architecture (SOA)

- Software Engineering

- Software and Development

- Web Design

- Web Design and Development

- Web Development and Technology

- XML

- Storage

- Agriculture

- Automotive

- Career

- Construction

- Education

- Engineering

- Broadcast Engineering

- Chemical

- Civil and Environmental

- Control Engineering

- Design Engineering

- Electrical Engineering

- GIS

- General Engineering

- Industrial Engineering

- Manufacturing Engineering

- Materials Science

- Mechanical Engineering

- Medical Devices

- Photonics

- Power Engineering

- Process Engineering

- Test and Measurement

- Finance

- Food and Beverage

- Government

- Healthcare and Medical

- Human Resources

- Information Technology

- Data Infrastructure

- Data Tools

- Desktops, Laptops and OS

- Chip Sets

- Collaboration Tools

- Desktop Systems - PCs

- Email Client

- Embedded Systems

- Hardware and Periferals

- Laptops

- Linux - Open Source

- Mac OS

- Memory Components

- Mobile Devices

- Presentation Software

- Processors

- Spreadsheets

- Thin Clients

- Upgrades and Migration

- Windows 7

- Windows Vista

- Windows XP

- Word Processing

- Workstations

- Enterprise Applications

- IT Infrastructure

- IT Management

- Networking and Communications

- Bluetooth

- DSL

- GPS

- GSM

- Industry Standard Protocols

- LAN - WAN

- Management

- Mobile - Wireless Communications

- Network

- Network Administration

- Network Design

- Network Disaster Recovery

- Network Interface Cards

- Network Operating Systems

- PBX

- RFID

- Scalability

- TCP - IP

- Telecom Hardware

- Telecom Regulation

- Telecom Services

- Telephony Architecture

- Unified Communications

- VPNs

- VoIP - IP Telephony

- Voice Mail

- WAP

- Wi-Fi (802.11)

- WiMAX (802.16)

- Wide Area Networks (WAN)

- Wireless Internet

- Wireless LAN

- Security

- Servers and Server OS

- Software and Web Development

- .Net Framework

- ASPs

- Application Development

- Application Servers

- Collaboration

- Component-Based

- Content Management

- E-Commerce - E-Business

- Enterprise Applications

- HTML

- IM

- IP Technologies

- Integration

- Internet

- Intranet

- J2EE

- Java

- Middleware

- Open Source

- Programming Languages

- Quality Assurance

- SAAS

- Service-Oriented Architecture (SOA)

- Software Engineering

- Software and Development

- Web Design

- Web Design and Development

- Web Development and Technology

- XML

- Storage

- Life Sciences

- Lifestyle

- Management

- Manufacturing

- Marketing

- Meetings and Travel

- Multimedia

- Operations

- Retail

- Sales

- Trade/Professional Services

- Utility and Energy

- View All Topics

Share Your Content with Us

on TradePub.com for readers like you. LEARN MORE

Request Your Free Checklist Now:

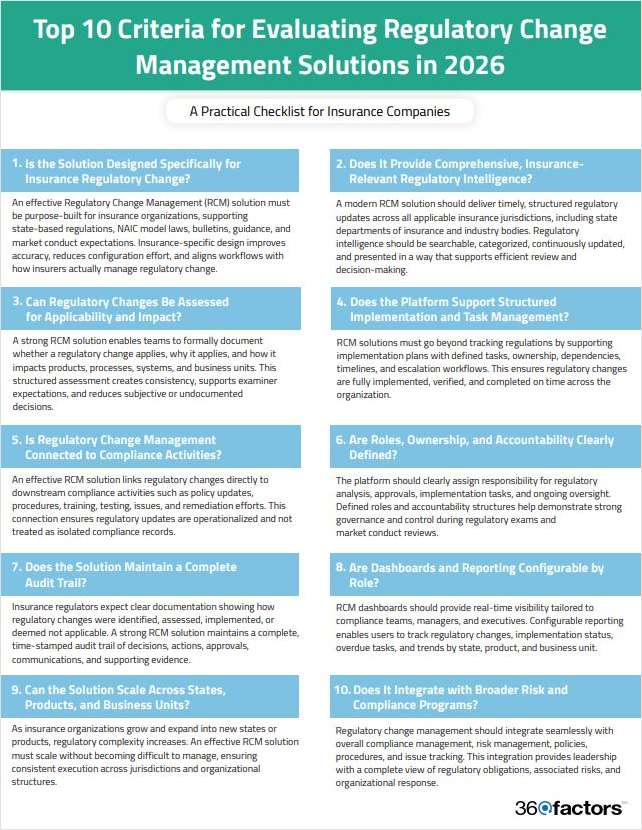

"Regulatory Change Management (RCM) Checklist for Insurance Companies"

A Practical Evaluation Guide for Insurance Organizations

Managing regulatory change across multiple products, lines of business, and states is one of the most complex challenges insurance organizations face today. New laws, bulletins, and regulatory guidance are issued continuously, making it difficult to track changes and ensure timely implementation.

Without a structured Regulatory Change Management approach, insurers risk inconsistent execution, missed obligations, weak documentation, and increased exposure during regulatory reviews and exams.

We’ve created a checklist to help insurers evaluate whether their current software, or a potential replacement, can help them handle today’s regulatory demands.

What’s Inside the Checklist

The Evaluation Checklist for Insurance outlines 10 criteria every modern regulatory change management solution should support. Each criterion focuses on real-world insurance regulatory needs, including:

- State-based regulatory change tracking

- NAIC model laws and regulatory guidance

- Applicability and impact assessment

- Implementation accountability and governance

- Audit-ready documentation and reporting

This checklist helps you focus on practical capabilities that matter to regulators and examiners.

Who This Checklist Is For

This checklist is ideal for:

- Insurance carriers (Property, Life, Health, etc.)

- Compliance and regulatory change teams

- Executives and decision-makers evaluating RCM tools

- Organizations preparing for regulatory exams

Whether you’re in early research or final vendor selection, this checklist helps ensure nothing critical is overlooked.

Offered Free by: 360factors

See All Resources from: 360factors